Pay By Link is a well-known payment method in Poland that allows customers paying their online shopping using their Bank accounts. SIBS Payment Gateway provides the API to integrate with Pay By Link services through the Web Redirect pattern.

The API provides the means to present your customer with the payment wall with all addressable entities. Once the customer chooses the entity to use, just call the API that will provide you with the appropriate redirect URL.

| Payment method | Category | Countries | Currencies | Features | Integrations |

|---|---|---|---|---|---|

| PayByLink | Online Banking | Poland | PLN | Refunds Cancellation | API Payment Form Prestashop Plugin WooCommerce Plugin Magento Plugin |

How it works

Before you start, you should create the order request with PayByLink as payment method.

After that, you should perform the following steps:

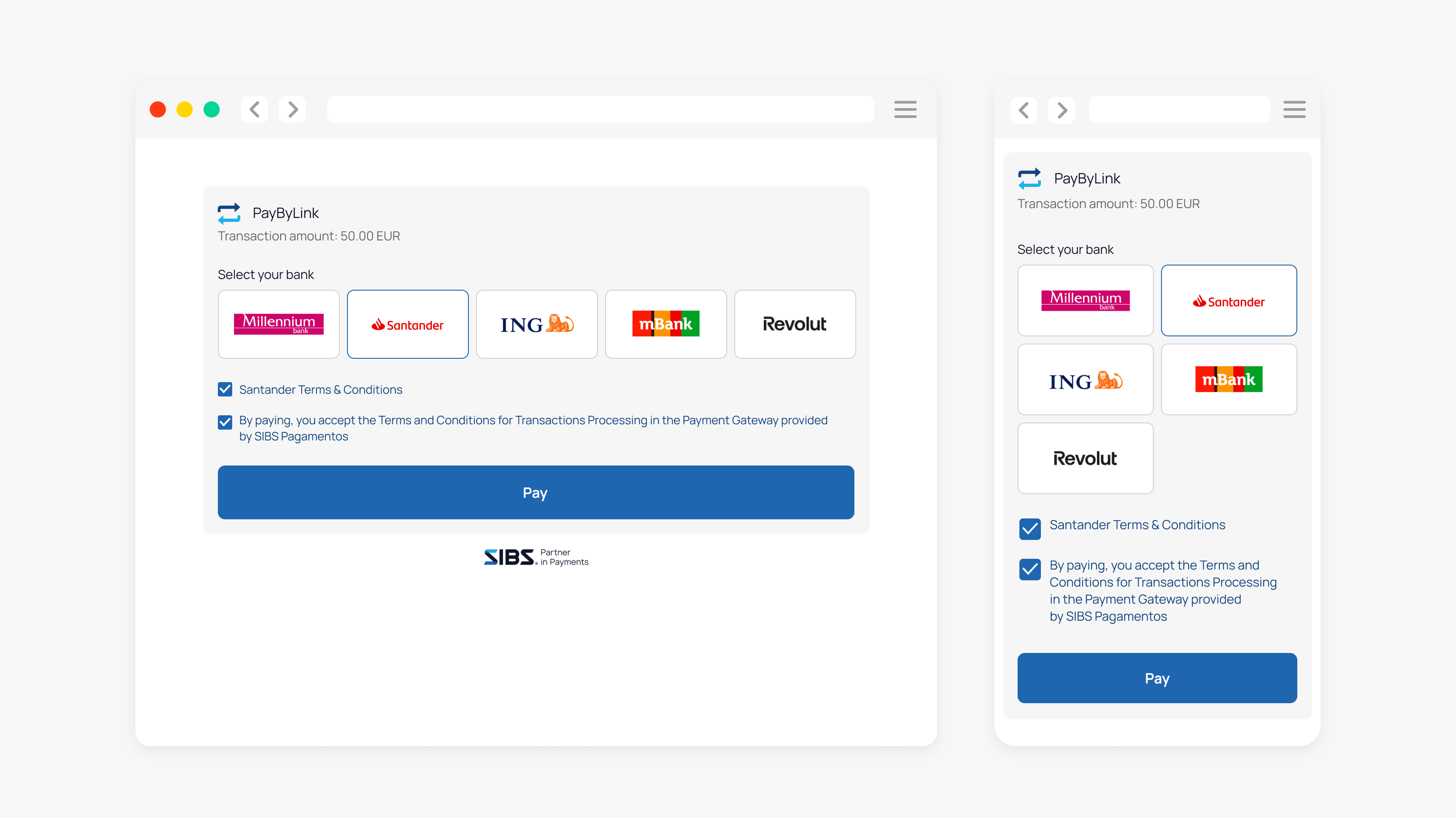

Step 1: Get the list of all PayByLink entities and present them to the customer

Step 2: Call the API to get the Regulation List

Step 3: Call the API to get a valid Payment Link for chosen entity

Step 4: Get the Payment Status to know the payment result

Step 1: Get the list of PayByLink entities and present them to the customer

You can check the list of all PayByLink entities making a GET request.

Please note that the request needs an Authorisation Header with the transactionsSignature returned from checkout operation.

Check below how to get the payment channels list:

| Operation | Operation Type | Operation Method & Endpoint | Operation Description | Observations |

|---|---|---|---|---|

| Get Payment Channels List | Synchronous Call | POST https://{{APIHost}}/api/v1/paymentChannels | Perform the transaction and report the Payment Channel List. | Content-Type: application/x-www-form-urlencoded |

| Location | Data Element | Type | Condition | Description |

|---|---|---|---|---|

| HTTP Header | Authorization | String | Optional | Example: Bearer *accessToken* User’s access token. Must be Bearer scheme. Not applicable for hybrid payments. |

| HTTP Header/Authorization | Client-Id | API Key | Mandatory | Project’s client id. Must be provided in a header with each request. |

| HTTP Header/Authorization | Client-Secret | API Key | Mandatory | Project’s client secret. Must be provided in a header with each request. |

Expected response:

A successful technical response comprises of an HTTP-200 status and a returnStatus.statusCode=”000″.

For successful responses you will receive the following additional data:

Payment Channels List:

"paymentChannels": [

{

"gatewayId": "PBL Gateway ID",

"gatewayName": "Name to present to customer",

"gatewayType": "PBL",

"bankName": "technical bank name",

"iconURL" : "https://paybylink.bank.pl/grafika/pbl.gif",

"statusDate": "2023-10-03T14:35:01"

}

]Step 2: Call the API to get the Regulation List

After getting the list of the available PayByLink entities, a POST request should be performed to receive the regulation list for the selected bank.

| Data Element | Type | Condition | Description |

|---|---|---|---|

| gatewayId | String | Mandatory | Payment Channel identifier for the channel the Customer is going to use for their payment. |

In this request, the Bearer Token is replaced by the checkout response “transactionSignature”.

Here’s an example:

Request URL:

https://stargate-cer.qly.site1.sibs.pt/api/v1/regulationsRequest Headers:

Authorization: Digest {transactionSignature}

X-IBM-Client-Id: b4480347-9fc8-4790-b359-100a99c60ea3

Content-Type: application/json{

"body": {

"gatewayId": "106"

}

}Upon completing the operation, the API response will contain the regulation ID:

- unique identifier for the specific regulation

- URL with more detailed information about the regulation, which can be accessed by the user

- type of the regulation

- inputLabel which indicates if there is any input lable associated with this regulation.

Response example below:

{

"transactionStatus": "ACTC",

"returnStatus": {

"statusCode": "000",

"statusMsg": "Success",

"statusDescription": "Success"

},

"regulations": [

{

"regulationId": "11984",

"url": "https://testpay.autopay.eu/webapi/regulation?ServiceID=903463&MessageID=e263bda2bc47536670569a1be8f691bd&Type=DEFAULT&Language=PL&Hash=6ab4a5df336351bdcb31c747ae46c54b3c554c2ddfed289584a4a53049ff3088",

"type": "DEFAULT",

"inputLabel": "null"

}

]

}Step 3: Call the API to get a valid Payment Link for the chosen entity

Note that the following request needs an Authorization Header with the transactionsSignature returned from checkout operation and you should include these two elements below:

| Data Element | Type | Condition | Description |

|---|---|---|---|

| gatewayId | String | Mandatory | Payment Channel identifier for the channel the Customer is going to use for their payment. |

| userAcceptanceIndicator | Boolean | Mandatory | Indicates if the user has accepted the Terms and Conditions, in order to continue with the payment. |

In this request, the Bearer Token is replaced by the checkout response “transactionSignature”.

Here’s an example:

Request URL:

https://stargate-cer.qly.site1.sibs.pt/api/v1/payments/{transactionID}/pbl/payment-linkRequest Headers:

Authorization: Digest {transactionSignature}

X-IBM-Client-Id: b4480347-9fc8-4790-b359-100a99c60ea3

Content-Type: application/json{

"info": {

"deviceInfo": {

"browserAcceptHeader": "application/json, text/plain, */*",

"browserJavaEnabled": "false",

"browserLanguage": "en",

"browserColorDepth": "24",

"browserScreenHeight": "1080",

"browserScreenWidth": "1920",

"browserTZ": "-60",

"browserUserAgent": "Mozilla/5.0 (Windows NT 10.0; WOW64) AppleWebKit/537.36 (KHTML, like Gecko) Chrome/106.0.0.0 Safari/537.36",

"geoLocalization": "Lat: 38.7350528 | Long: -9.2143616",

"systemFamily": "Windows",

"systemVersion": "Windows",

"deviceID": "498bfd4c3a3645b38667a7037b616c18",

"applicationName": "Chrome",

"applicationVersion": "106"

},

"customerInfo": [

{

"key": "customerName",

"value": "Test Name"

},

{

"key": "customerEmail",

"value": "email@provider.com"

}

]

},

"gatewayId": "106",

"userAcceptanceIndicator": true,

"merchant": {

"merchantURL": "https://egadget2.azurewebsites.net/#/returns?id={{transactionId}}"

}

}Upon completing the operation, you should receive a pending paymentStatus.

The user will be redirected to PBL environment to confirm the payment and then will be redirected back to the merchant URL.

{

"transactionID": "q6Gb8jFT7Ag0UGCTApMM",

"execution": {

"startTime": "2025-01-09T16:47:45.754Z",

"endTime": "2025-01-09T16:47:48.840Z"

},

"paymentStatus": "Pending",

"returnStatus": {

"statusCode": "000",

"statusMsg": "Success",

"statusDescription": "Success"

},

"redirectURL": "https://testpay.autopay.eu/web/payment/continue/AX7B553VIB/1BHFTSH9K"

}Step 4: Get the Payment Status to know the payment result

Once the payment has been completely processed, you can check the status of your transaction making a GET request.

The Authorization HTTP header is set to the Bearer token as it was used in the initial Checkout.

| Operation | Operation Type | Operation Method & Endpoint | Operation Description |

|---|---|---|---|

| Get Payment Status | Synchronous Call | GET /api/v1/payment/{transactionId}/status | Obtain the payment status |

Body:

| Location | Data Element | Type | Condition | Description |

|---|---|---|---|---|

| Query Parameter | transactionId | String | Mandatory | Payment identification. Example: 9078fbb0-fced-4606-95c7-4989f06ee253 |

| HTTP Header | Authorization | String | Optional | Example: Bearer *accessToken* User’s access token. Must be Bearer scheme. Not applicable for hybrid payments. |

| HTTP Header/Authorization | Client-Id | API Key | Mandatory | Project’s client id. Must be provided in a header with each request. |

| HTTP Header/Authorization | Client-Secret | API Key | Mandatory | Project’s client secret. Must be provided in a header with each request. |

Expected response with success:

{

"merchant": {

"terminalId": "101778",

"merchantTransactionId": "Order Id: r7cxvi0saj"

},

"transactionID": "J120XDzUq2u4UwVDSZBt",

"amount": {

"currency": "PLN",

"value": "50.50"

},

"paymentType": "PURS",

"paymentStatus": "Success",

"paymentMethod": "PAY_BY_LINK",

"execution": {

"endTime": "2023-06-20T10:07:27.771Z",

"startTime": "2023-06-20T10:07:27.701Z"

},

"returnStatus": {

"statusCode": "000",

"statusMsg": "Success",

"statusDescription": "Success"

}

}A successful technical response comprises of an HTTP-200 status and a returnStatus.statusCode=”000″.

Here are some examples of the possible result codes:

| Result Code | statusMsg | Description | Action |

|---|---|---|---|

| HTTP-200 | Success | Success response | N/A |

| HTTP-400 | Bad Request | The JSON payload is not matching the API definition or some mandatory HTTP headers are missing. | Please check in API Market for the correct syntax. |

| HTTP-401 | Unauthorized | On the Authorization, Bearer token is invalid/expired or not associated with the Terminal used. | Please check in SIBS Backoffice under the Credentials if the token is valid and create a new one if needed. |

| HTTP-403 | Forbidden | The ClientID set on the X-IBM-Client-Id HTTP header is not valid or does not possess a valid subscription to the API. | Please check in SIBS Backoffice under the SPG APP 2.0 if the ClientID is correct. If the problem persists contact SIBS Gateway support for a ClientID reset. |

| HTTP-405 | Method Not Allowed | The HTTP Method used is not matching any of the API definitions available. | Please check in API Market for the correct HTTP Method. |

| HTTP-429 | Too Many Requests | The API calls rate limit has been exceeded. | Please check in API Market for information on the rate limits that apply to the API. |

| HTTP-500 | Internal Server Error | The API call has failed… and its most likely on our side. | You should retry the operation, and if the problem persists contact SIBS Gateway support for assistance. |

| HTTP-503 | Service Unavailable | The API call is not currently available. Usually we are always on, but short availability issues may occur during scheduled maintenance. | You should wait and try again later. |