SIBS Payment Gateway

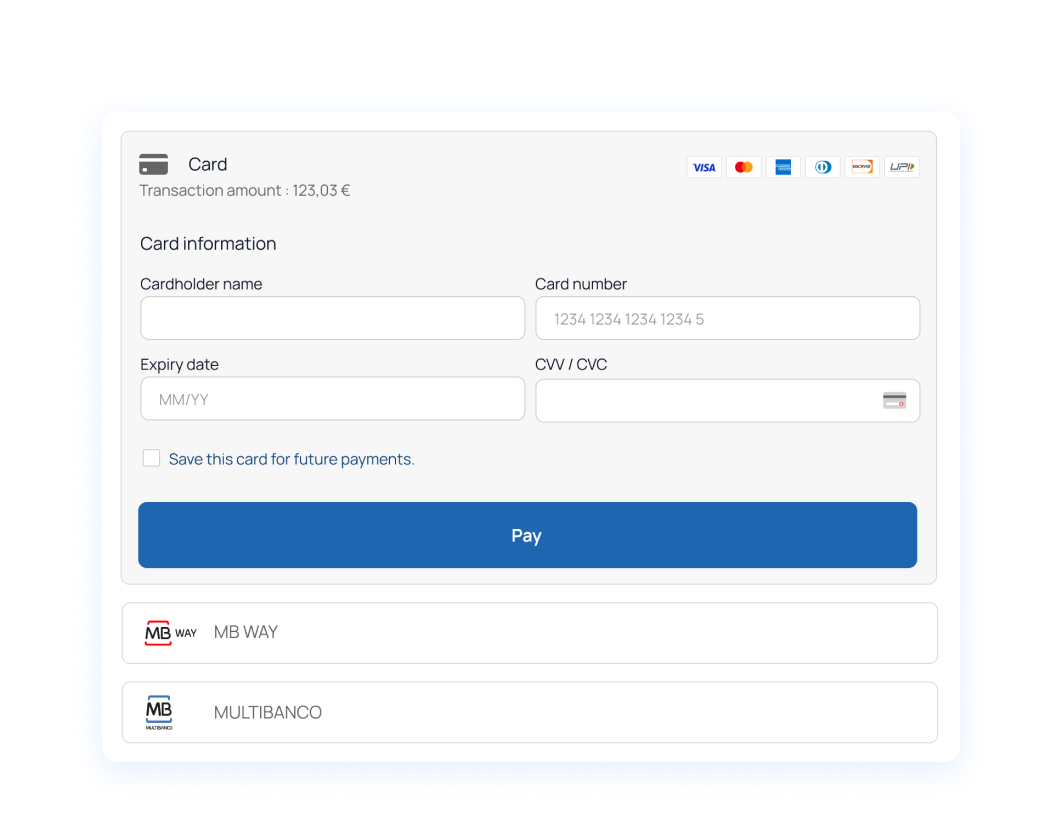

Allow your business grow. An online payment solution fully developed for your business that allows you to reduce costs and manage your business more efficiently.

Provide a smooth, time-efficient, and highly secure payment experience, empowering your customers to confidently select their preferred payment method across any device.

Smart terminals

Accept MB WAY, card (domestic or international) and wallet payments, through contactless technology, chip or magnetic stripe.

Empower your business operations through seamless integration of your management tools with our Smart payment terminals. Customisable applications, smooth adaptation and effortless integration.

Gain complimentary access to our Backoffice, offering real-time transaction management for shop from a single, convenient location. Monitor and control terminals transactions effortlessly, ensuring seamless operations and enhanced efficiency for your business.

Marketplace

Every transaction, from payment processing to the transfer of funds, is handled securely and in compliance with legal standards. Identity check is guaranteed for all Submerchants registered.

Automate splits and payouts with our Marketplace API to reduce the administrative workload involved in processing payments. Focus on growth and development rather than heavy financial administration.

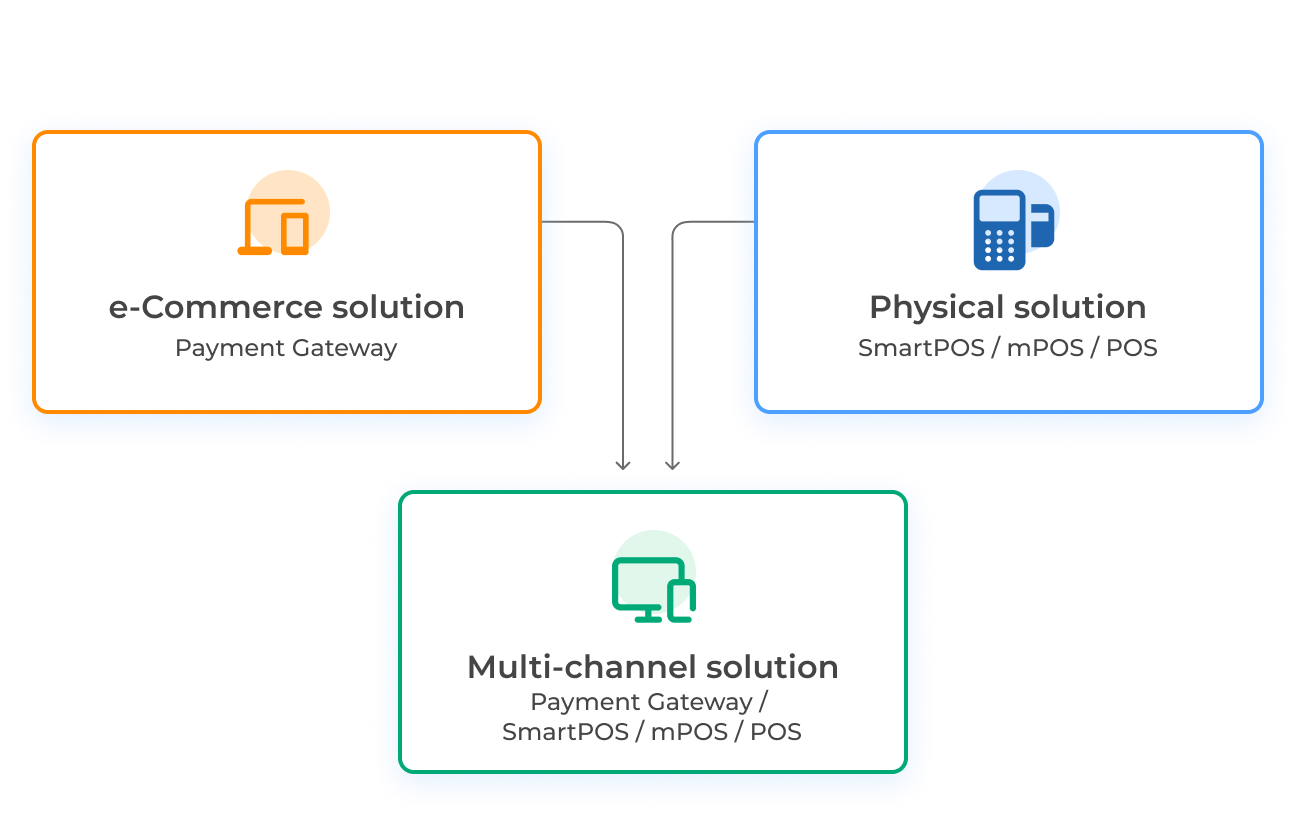

Accept transactions online and in-store and manage payouts remotely. SIBS Marketplace integrates both physical and online businesses and supports a variety of payment methods through our SIBS Payment Gateway and physical POS.

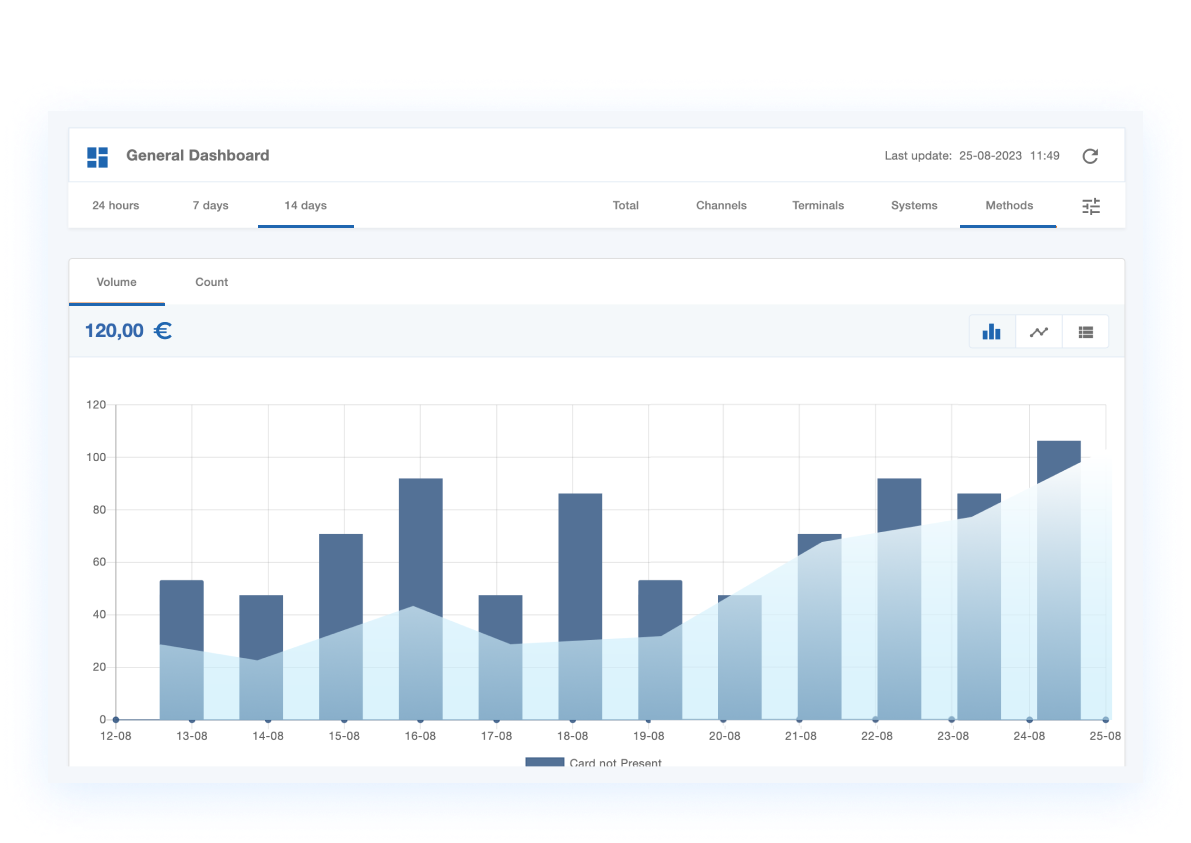

SIBS Backoffice

On SIBS Backoffice you can setup and manage your payment operation in a much simpler, quicker, and straightforward way.

SIBS Backoffice also provides analytics tools that allow you to gain deep insights into your payment data. These tools can help you identify trends, spot opportunities for optimization, and make data-driven decisions that can have a significant impact on your business.

Integrations

Integrations