Server-to-Server Integration enables direct communication between the merchant and SIBS.

Throughout this integration, the card holder can finalize the payment without being redirected to SIBS Gateway form.

Please note, that in order to use Card payments with Server-To-Server integration method, it’s mandatory being PCI-DSS Compliant, which allows merchants flexible workflows on front-end and back-end processes.

Server-to-Server integration is based on the following steps:

Prepare the checkout: sends payment data, including payment method data.

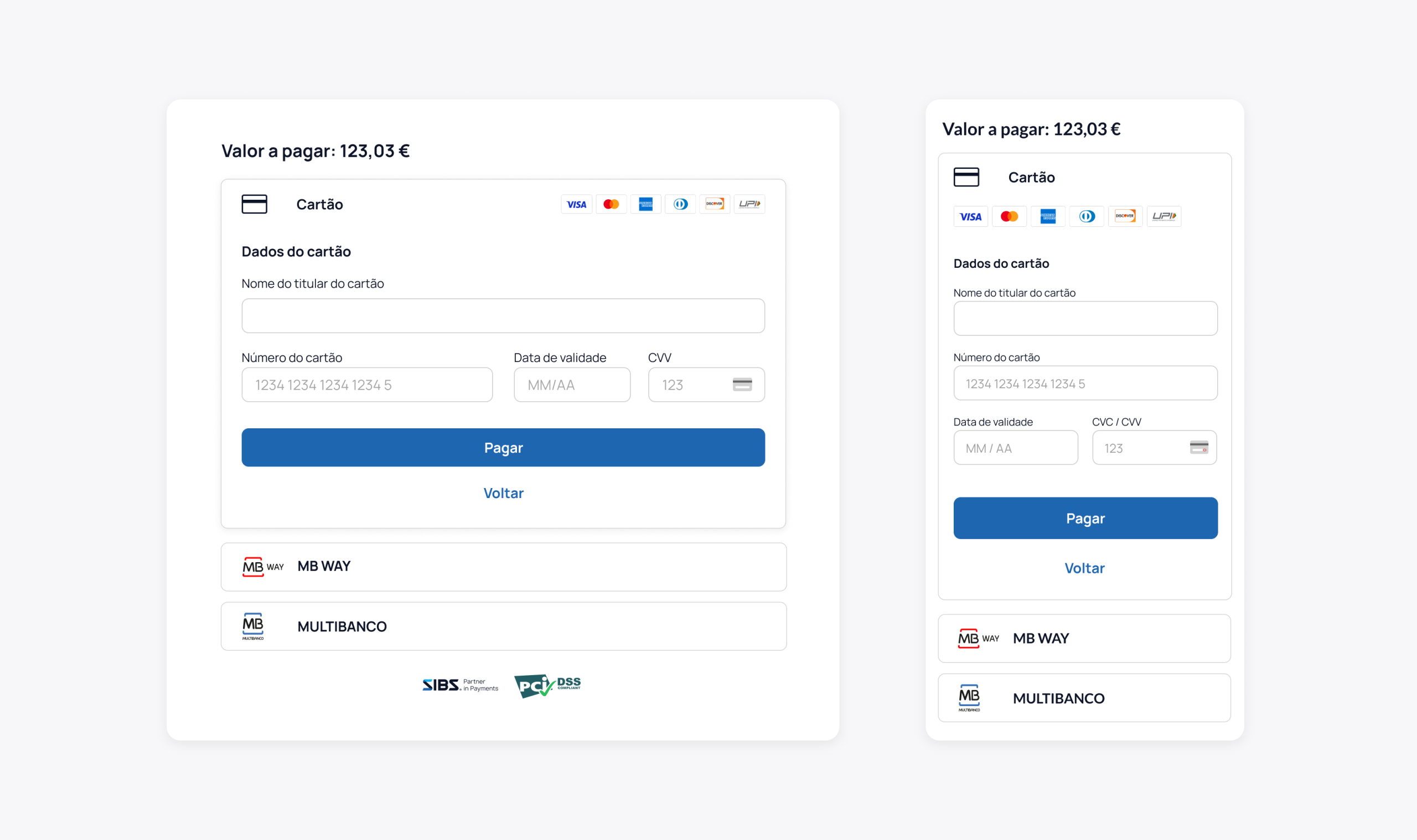

Display payment method options to customer: displays payment method options to customer and get payment data from the customer including: MB WAY ID, MULTIBANCO, Authorised Payments and Card.

Update payment method data: sends payment method and its required data.

Get the payment status: gets the payment status.

Merchant Notification: Receive payment status.

Endpoints

Widget Endpoint: The <ROOT_URL> will depend on the environment where we are working.

ROOT_URL QLY

https://api.qly.sibspayments.com

ROOT_URL PRD

https://api.sibspayments.com

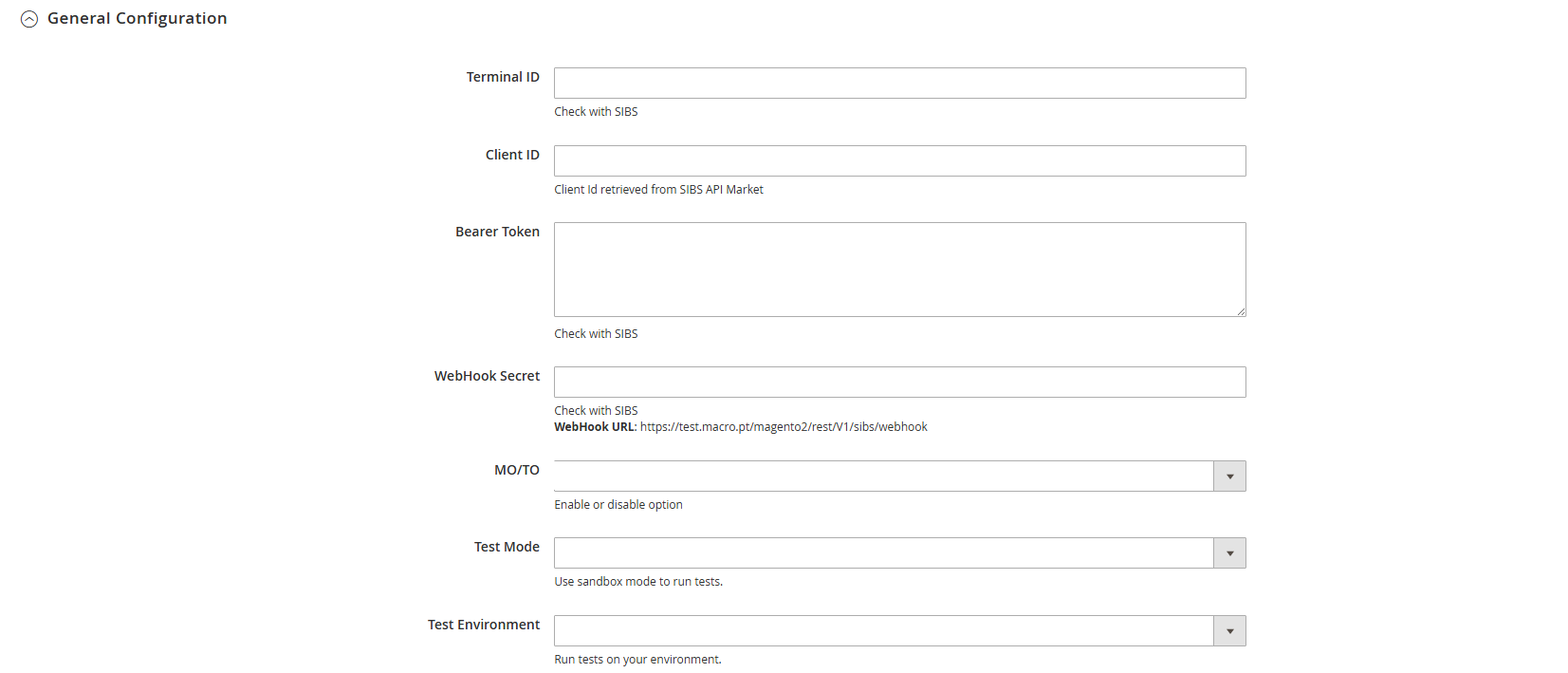

To be a valid Merchant on SIBS Gateway V02.00 it will be necessary to have an authorisation token (<AuthToken>), <terminalId>.

Create Checkout Server-to-Server

Firstly, perform a Server-to-Server POST request, to prepare the checkout with the required data, where you should include the order type, amount, currency and payment methods allowed.

The JSON of your POST body, can be composed of various Complex Types:

Merchant (Mandatory)

"merchant": {

"terminalId": {{terminalId}},

"channel": "web",

"merchantTransactionId": "{{mti}}"

}

Transaction (Mandatory)

"transaction": {

"transactionTimestamp": "Current Date",

"description": "My transaction -> Order XPTO",

"moto": false,

"paymentType": "PURS",

"amount": {

"value": 5,

"currency": "EUR"

},

"paymentMethod": [

"REFERENCE",

"CARD",

"MBWAY"

],

"paymentReference": {

"initialDatetime": "Current Date",

"finalDatetime": "Expiration Date",

"maxAmount": {

"value": 5,

"currency": "EUR"

},

"minAmount": {

"value": 5,

"currency": "EUR"

},

"entity": "24000"

}

}

Customer Info (Mandatory For Card)

"customer": {

"customerInfo": {

"customerEmail": "client.name@hostname.pt",

"shippingAddress": {

"street1": "Rua 123",

"street2": "",

"city": "Lisboa",

"postcode": "1200-999",

"country": "PT"

},

"billingAddress": {

"street1": "Rua 123",

"street2": "",

"city": "Lisboa",

"postcode": "1200-999",

"country": "PT"

}

}

}

Recurring Transaction (Optional)

"recurringTransaction": {

"validityDate": "2022-09-28T17:37:31.4095147+00:00",

"amountQualifier": "DEFAULT",

"description" : "My transaction -> Order XPTO"

}

Tokenization (Optional)

"tokenisation":{

"tokenisationRequest":{

"tokeniseCard":true

}

}

The response to a successful request is a JSON with a transactionID, which is required on the second step to create a transaction.

With the transactionID, will be present as well a transactionSignature that will be used on the next step.

The available endpoint destination URL is:

POST https://spg.qly.site1.sibs.pt/api/v2/payments

Here's how you can run this locally:

Request URL

https://spg.qly.site1.sibs.pt/api/v2/payments

Request Headers

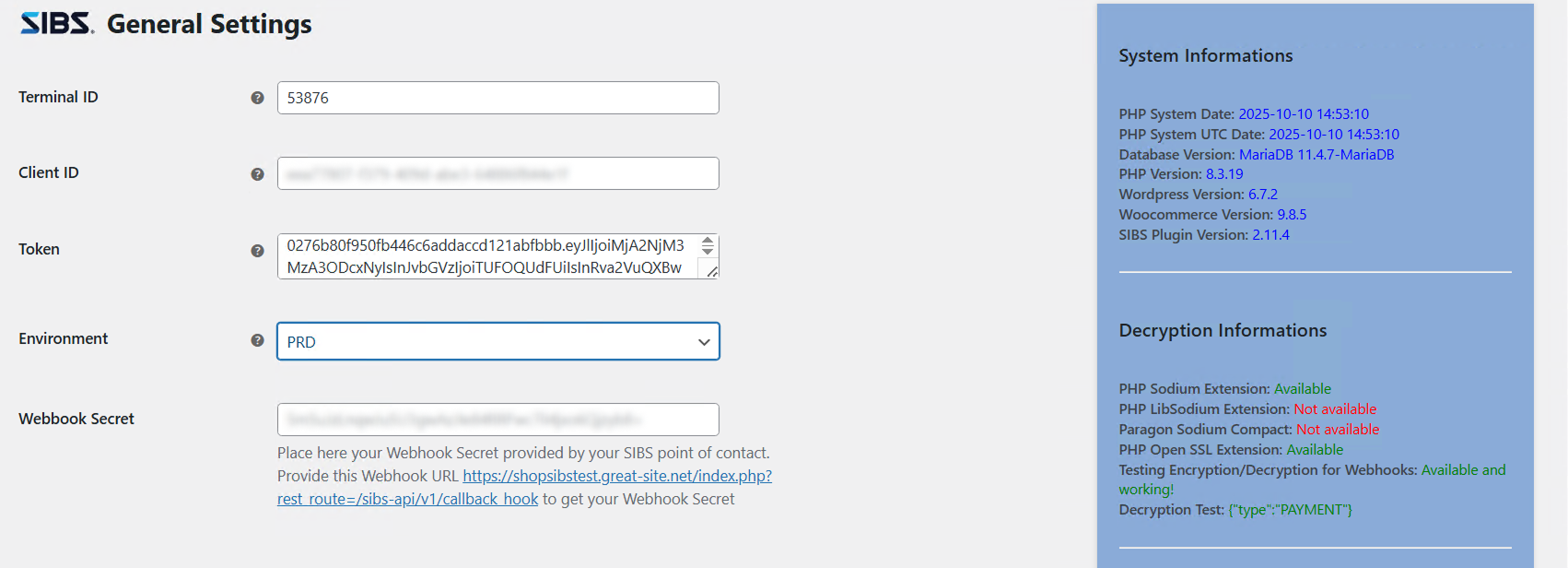

Authorization: Bearer 0276b80f950fb446c6addaccd121abfbbb.eyJlIjoiMTk4N (...)

X-IBM-Client-Id: 8247e05b-e64d-4948-843d-6e8b30224e39

Content-Type: application/json

Request body

{

"merchant": {

"terminalId": 52221,

"channel": "web",

"merchantTransactionId": "Order ID: r1cm97qqjv"

},

"transaction": {

"transactionTimestamp": "2023-11-09T10:31:44.989Z",

"description": "Your own description",

"moto": false,

"paymentType": "PURS",

"amount": {

"value": 5.5,

"currency": "EUR"

},

"paymentMethod": [

"CARD",

"MBWAY",

"REFERENCE"

],

"paymentReference": {

"initialDatetime": "2023-11-09T10:31:44.989Z",

"finalDatetime": "2023-11-11T10:31:44.989Z",

"maxAmount": {

"value": 5.5,

"currency": "EUR"

},

"minAmount": {

"value": 5.5,

"currency": "EUR"

},

"entity": "24000"

}

}

}

Request checkout

{

"amount": {

"value": 5.5,

"currency": "EUR"

},

"merchant": {

"terminalId": "52221",

"merchantTransactionId": "Order ID: r1cm97qqjv"

},

"transactionID": "s2CB2CH3U91PdGDHsacJ",

"transactionSignature": "eyJ0eElkIjoiczJDQjJDSDNVOTFQZEdESHNhY0oiLCJtYyI6OTk5OTk5OSwidGMiOjUyMjIxfQ==.iouf6xtVLCzwj1tFFJfwpbepumscI6jAfQ50PuMmrpI=.XJIJNOgI3ZrvCFef6yFXl1gT6Wab0WH4Y+bthuRWRtTGux5QVtBqFXpKWV7cXwxG",

"formContext": "eyJQYXltZW50TWV0aG9kIjpbIkNBUkQiLCJNQldBWSIsIlJFRkVSRU5DRSJdLCJUcmFuc2FjdGlvblNpZ25hdHVyZSI6ImV5SjBlRWxrSWpvaWN6SkRRakpEU0ROVk9URlFaRWRFU0hOaFkwb2lMQ0p0WXlJNk9UazVPVGs1T1N3aWRHTWlPalV5TWpJeGZRPT0uaW91ZjZ4dFZMQ3p3ajF0RkZKZndwYmVwdW1zY0k2akFmUTUwUHVNbXJwST0uWEpJSk5PZ0kzWnJ2Q0ZlZjZ5RlhsMWdUNldhYjBXSDRZK2J0aHVSV1J0VEd1eDVRVnRCcUZYcEtXVjdjWHd4RyIsIkFtb3VudCI6eyJBbW91bnQiOjUuNSwiQ3VycmVuY3kiOiJFVVIifSwiTWFuZGF0ZSI6eyJNYW5kYXRlQXZhaWxhYmxlIjpmYWxzZX0sIkFwaVZlcnNpb24iOiJ2MSIsIk1PVE8iOmZhbHNlfQ==",

"expiry": "2023-11-09T10:41:44.989Z",

"tokenList": [],

"paymentMethodList": [

"CARD",

"MBWAY",

"REFERENCE"

],

"execution": {

"startTime": "2023-11-09T15:33:29.460Z",

"endTime": "2023-11-09T15:33:29.611Z"

},

"returnStatus": {

"statusCode": "000",

"statusMsg": "Success",

"statusDescription": "Success"

}

}

Generate transaction

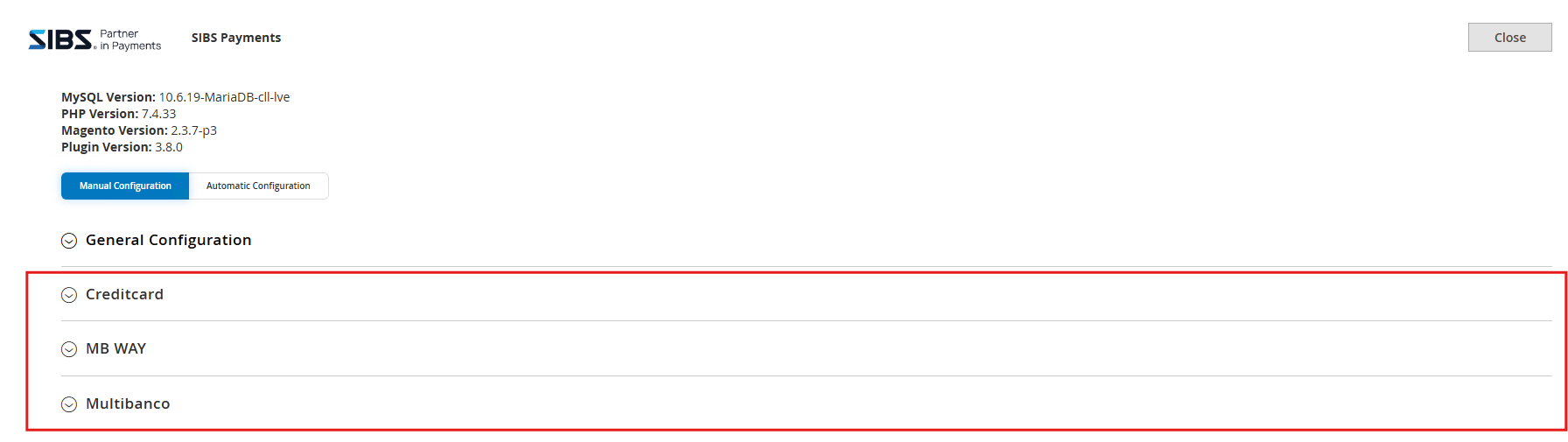

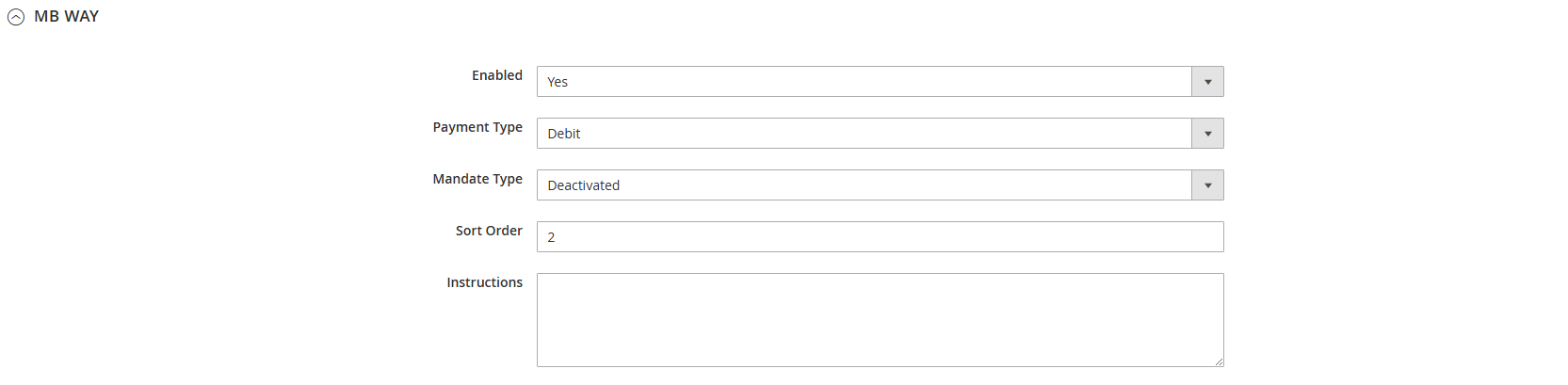

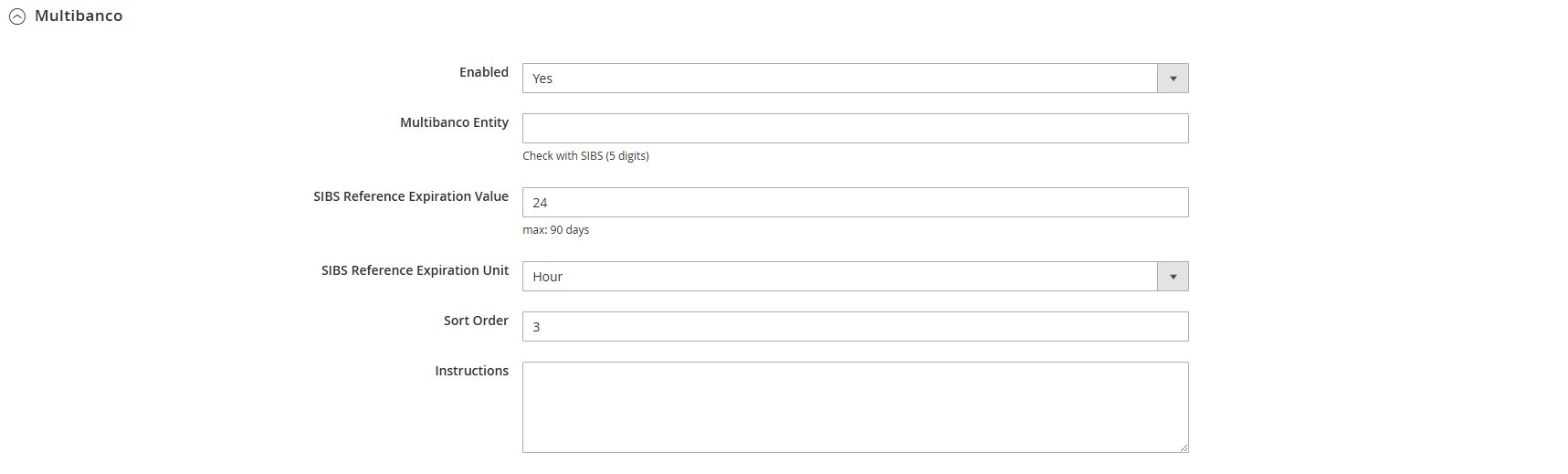

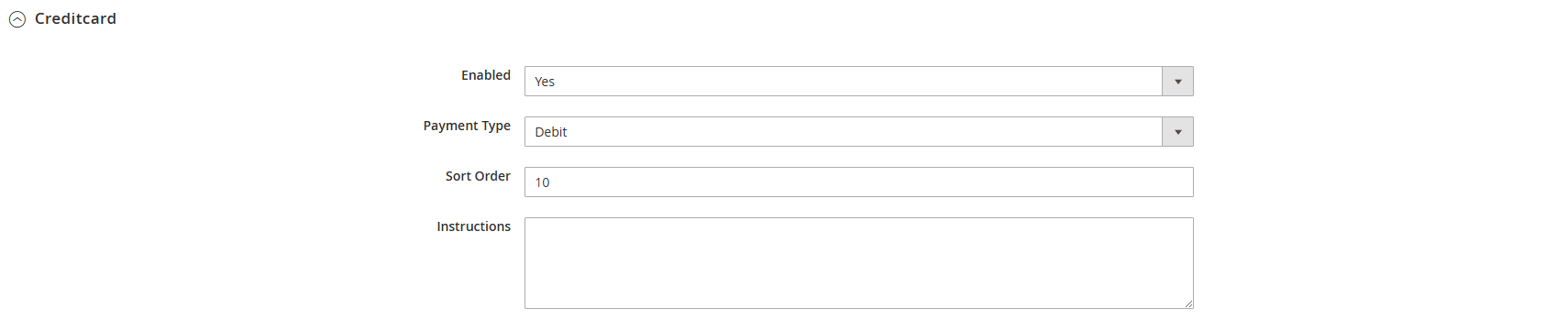

Configuration on Server-to-Server

Note that all the following requests need an Authorisation Header with the “transactionSignature” returned from checkout operation.

On these requests, the Bearer Token is replaced by the checkout response “transactionSignature”.

Example

Authorization: Digest {transactionSignature}

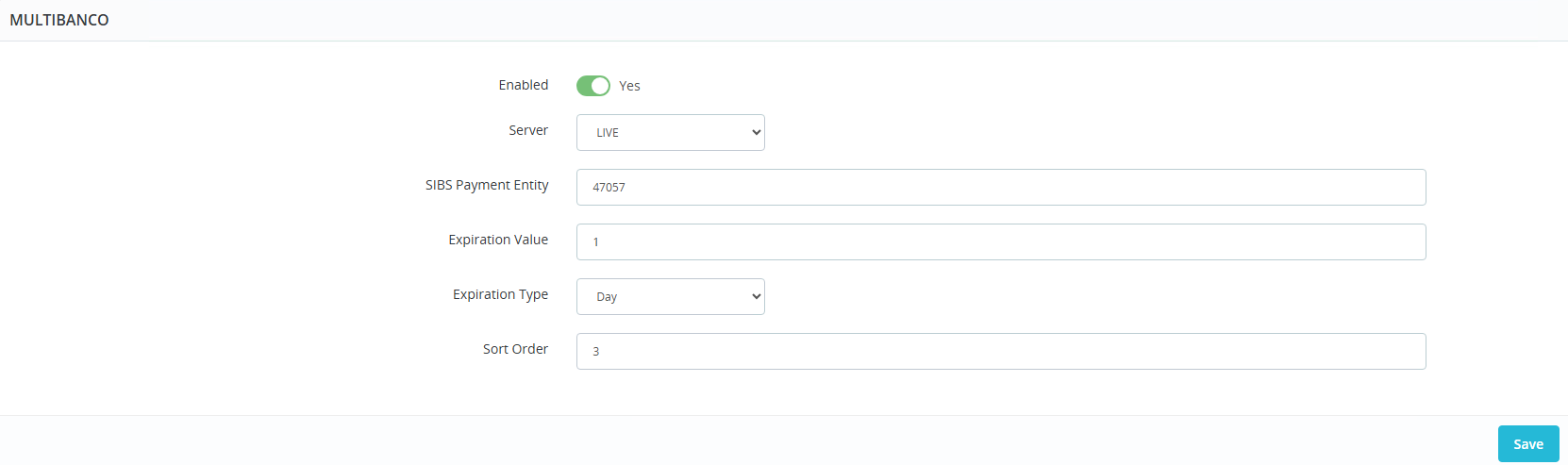

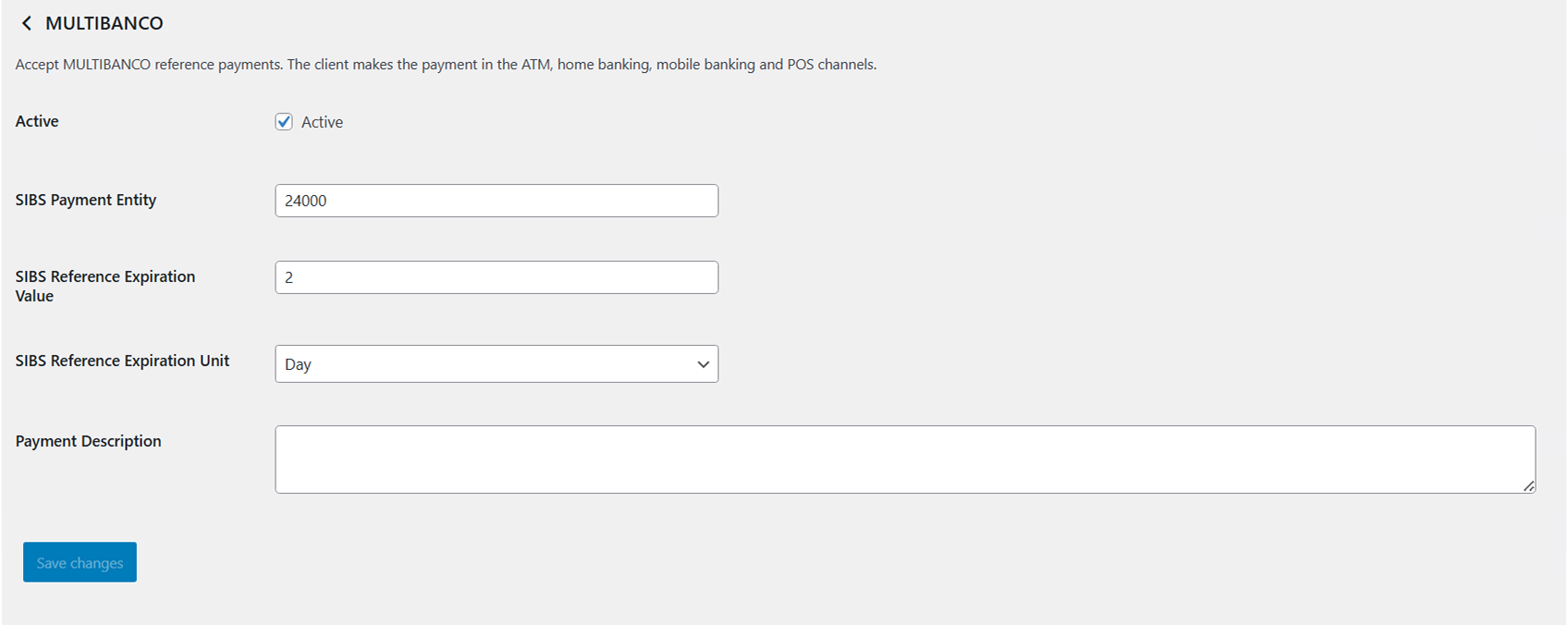

MULTIBANCO

POST https://spg.qly.site1.sibs.pt/api/v2/payments/{transactionID}/service-reference/generate

Request URL

https://spg.qly.site1.sibs.pt/api/v2/payments/{transactionID}/service-reference/generate

Request headers

Authorization: Digest {transactionSignature}

X-IBM-Client-Id: 8247e05b-e64d-4948-843d-6e8b30224e39

Content-Type: application/json

Request body

Ocurred an error sending post to

https://spg.qly.site1.sibs.pt/api/v2/payments//service-reference/generate

Response Body:

undefined

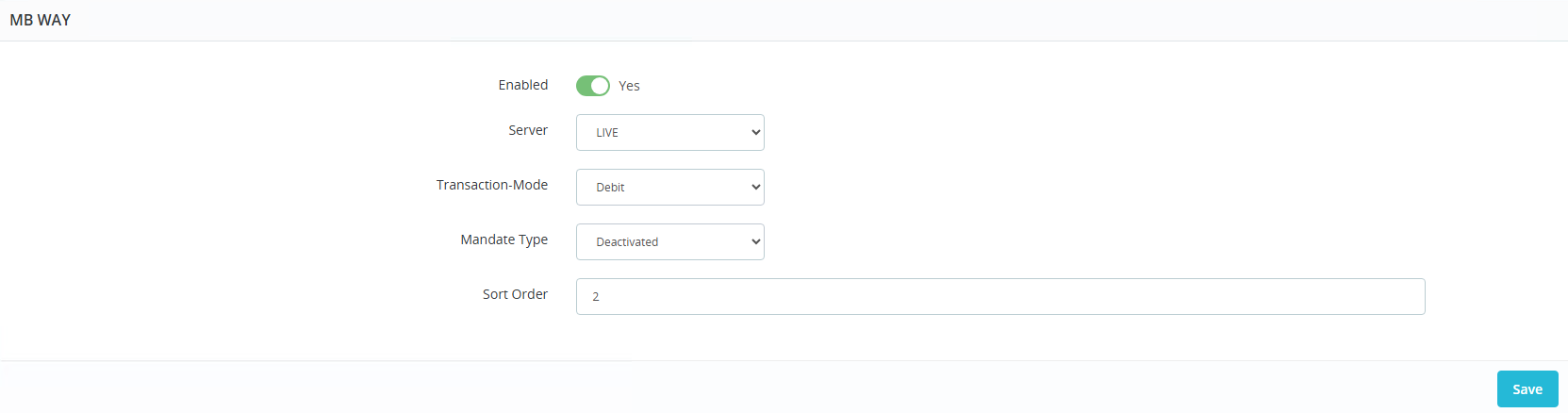

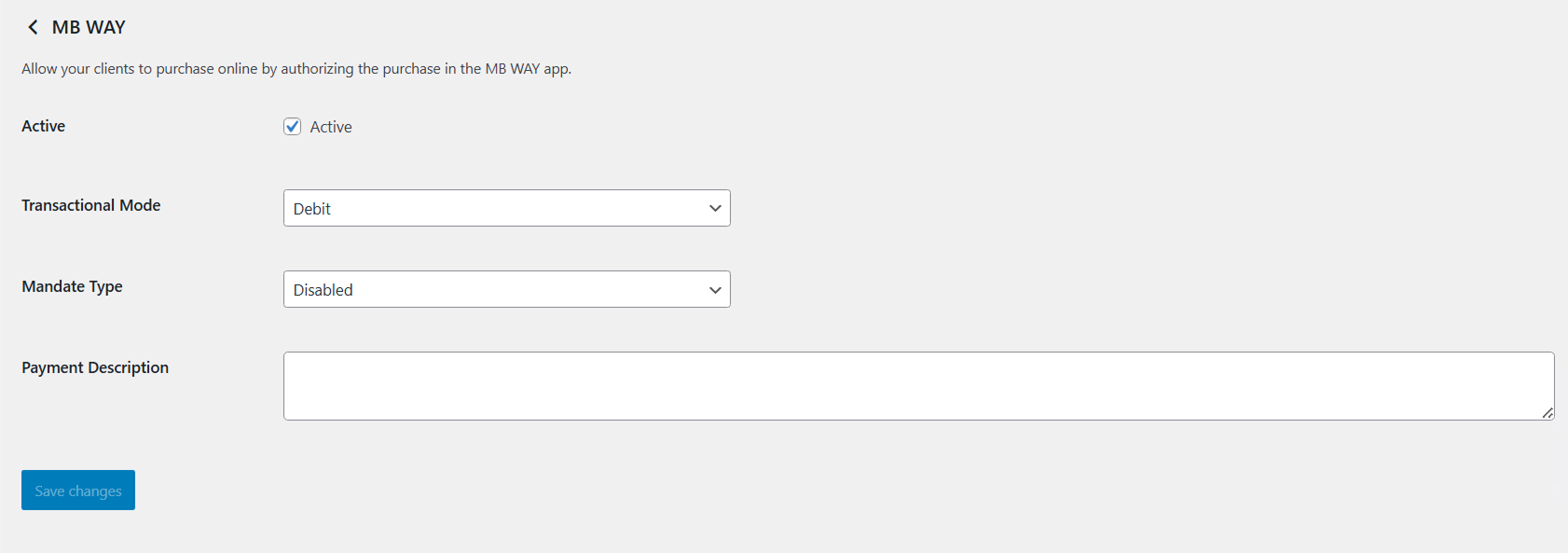

MB WAY

Generate MB WAY payment

Insert the phone number to use:

POST https://spg.qly.site1.sibs.pt/api/v2/payments/{transactionID}}/mbway-id/purchase

Request URL

https://spg.qly.site1.sibs.pt/api/v2/payments/s2CB2CH3U91PdGDHsacJ/mbway-id/purchase

Request headers

Authorization: Digest {transactionSignature}

X-IBM-Client-Id: 8247e05b-e64d-4948-843d-6e8b30224e39

Content-Type: application/json

Request body

{

"customerPhone": "351#919999999"

}

{

"transactionID": "s2CB2CH3U91PdGDHsacJ",

"execution": {

"startTime": "2023-11-09T16:19:11.924Z",

"endTime": "2023-11-09T16:19:12.052Z"

},

"paymentStatus": "Timeout",

"returnStatus": {

"statusCode": "000",

"statusMsg": "Success",

"statusDescription": "Success"

}

}

Get the payment status

Once the payment has been processed, you must redirect the client to a thank you page and present a message depending on the paymentStatus. You can check the status of your transaction by making a GET request.

GET https://spg.qly.site1.sibs.pt/api/v2/payments/{transactionID}/status

Request URL

https://spg.qly.site1.sibs.pt/api/v2/payments/s2CB2CH3U91PdGDHsacJ/status

Request headers

Authorization: Bearer 0276b80f950fb446c6addaccd121abfbbb.eyJlIjoiMTk4N (...)

X-IBM-Client-Id: 8247e05b-e64d-4948-843d-6e8b30224e39

Content-Type: application/json

Ocurred an error on the GET request to

https://spg.qly.site1.sibs.pt/api/v2/payments/s2CB2CH3U91PdGDHsacJ/status

Response body

{

"merchant": {

"terminalId": "52221",

"merchantTransactionId": "Order ID: r1cm97qqjv"

},

"transactionID": "s2CB2CH3U91PdGDHsacJ",

"amount": {

"currency": "EUR",

"value": "5.50"

},

"paymentType": "PURS",

"paymentStatus": "Timeout",

"paymentMethod": "MBWAY",

"execution": {

"endTime": "2023-11-09T16:44:56.359Z",

"startTime": "2023-11-09T16:44:56.246Z"

},

"returnStatus": {

"statusCode": "999",

"statusMsg": "Validation Request Failed",

"statusDescription": "Please try again."

}

}