Activate subscriptions and recurring payments in your business and watch your sales grow.

More sales

Reduce the loss of purchase funnel in your business and provide a better buying experience for your customers

Customer loyalty

Increase recurring purchases and customer retention in your business by making your

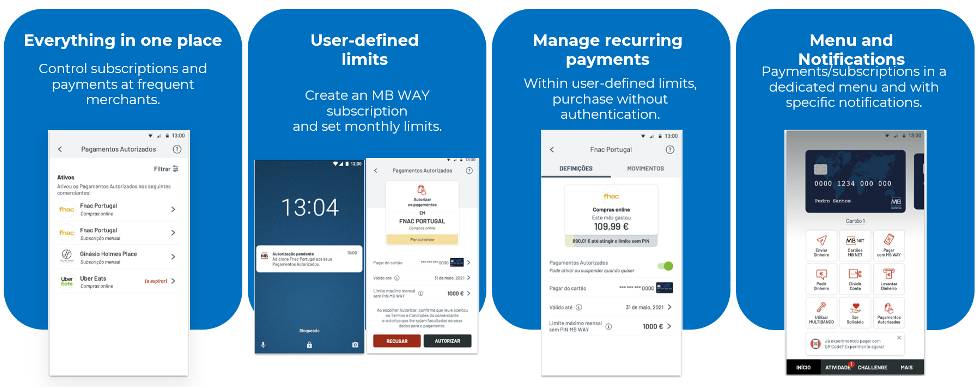

Business control

You can easily track how many customers have subscribed or cancelled the subscription service

How it works

MB WAY Authorised Payments allow your customers to make a one-time approval of a predefined amount that can be charged for each purchase or subscription/month without requiring further approvals. This will allow your customers to make purchases in your online store or Marketplace with just one click, significantly simplifying the purchasing process, encouraging recurring purchases and thus contributing to increased sales.

At the checkout of your online store offer the payment method “MB WAY Authorised Payments” and your customers will only need to complete the process on their MB WAY app.

Subscriptions

Automatic payments of subscriptions (monthly, annual, or other) without the need for the consumer to authenticate each payment, on each of the billing dates.

One Click

Payments for one-off purchases at a merchant, where the consumer can make the next purchases without having to validate.

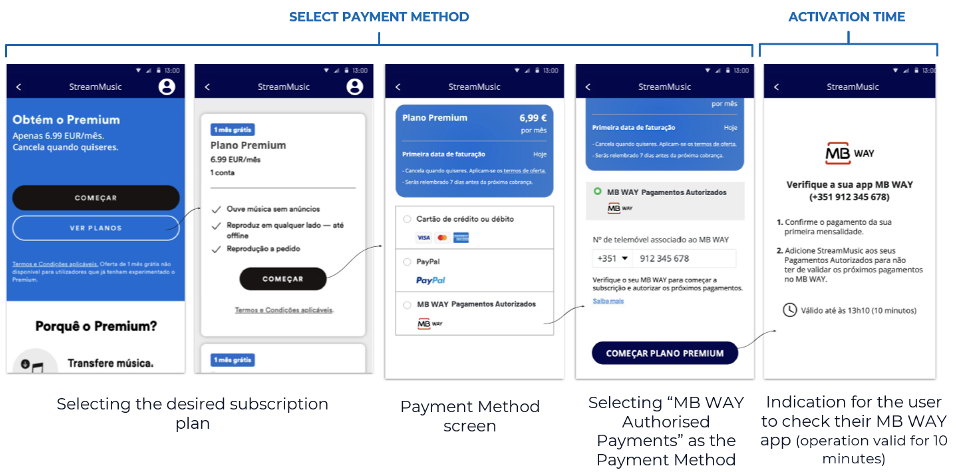

How it starts

The process of subscribing to the Authorised Payments feature is simple, fast and designed to offer maximum convenience and security for both users and member companies. This process takes place digitally and is easily managed via the MB WAY app, ensuring a smooth experience.

The subscription consists of the user choosing the company or service for which they want to activate authorised payments. This option usually appears at the time of contracting or when making the initial payment for a good or service, as described below.

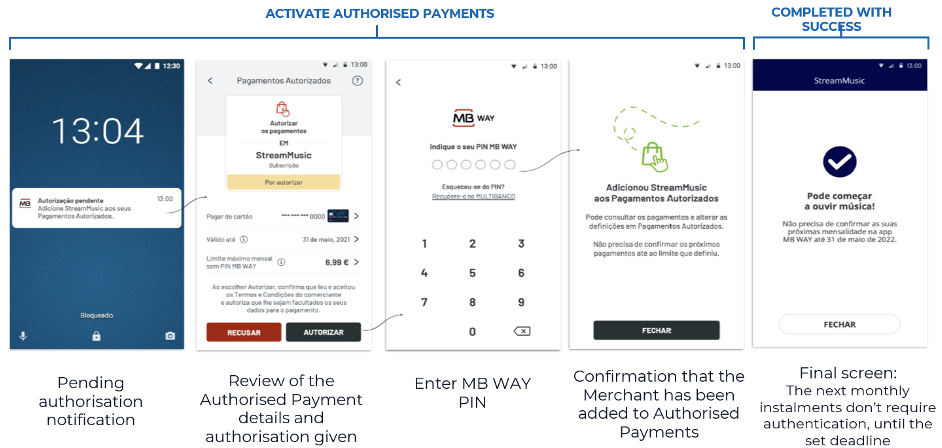

Step 1: Authorisation Request

The company issues a payment authorisation request to the user, which is sent directly to the MB WAY app via the SIBS Gateway. This request includes clear information on the amounts, the frequency (if applicable) and the terms of the authorisation.

Step 2: Confirmation and Authentication

The user receives a notification in the MB WAY app and is directed to the order detail. After checking the conditions presented, they confirm the authorisation using strong authentication (e.g. MB WAY PIN or biometrics). This step ensures that only the authorised user can validate the process.

Step 3: Authorisation activation

After confirmation, the authorisation is activated, allowing the company to process future payments within the agreed limits. The user can, at any time, consult, modify or cancel this authorisation directly in the MB WAY app.

This operation significantly improves the customer experience by eliminating the need for repeated authorisations, promoting greater convenience and loyalty. With MB WAY Authorised Payments, SIBS offers a practical and efficient solution that benefits both consumers and merchants, facilitating day-to-day payment management and contributing to more modern and effective collection processes.

Subscription / Creation – Merchant website version

Subscription / Creation – MB WAY app version

Business value proposition

Merchants with Authorised Payments