Initial Setup

vTerminal is a virtual terminal that allows you to accept financial transactions via MB WAY and MULTIBANCO reference.

To use vTerminal, you will need to have a SIBS Payment Gateway offer under contract with your financial institution, with at least one terminal associated.

To start accepting payments via vTerminal, you will need to create a credential in SIBS Backoffice.

In order to create a credential, go to the “Credentials” menu and click on “Add Credential”.

The form to add a credential will have the following fields:

- Credential: the name for the credential

- Role: the type of role associated.

- Terminal: the terminal to associate to the credential being created.

Accepting a Payment

Go to “SIBS Payment Gateway 2.0” > “vTerminal”.

If you have only one terminal, you will be redirected automatically to the “vTerminal” payment screen.

In case you have two or more terminals setup, a screen with a list of terminals will be displayed. You can choose the terminal you want to use by clicking on the following icon. ![]()

In order to accept a payment using MB WAY as the payment method, you will need to fill out the following fields:

| Field | Description | Required |

|---|---|---|

| Payment Type | Payment type you want to use: – Authorization: via MB WAY; – Purchase: via MB WAY | YES |

| Amount | Total amount of the purchase. Minimum value of 0,01€. | YES |

| Currency | Euro is the predefined, non-editable currency. | YES |

| Entity | Warning: In order to generate a MB WAY operation, leave the field blank. | – |

| Merchant Operation ID | Internal merchant code ID. | YES |

| Merchant User ID | Client’s identificator number. To fill if the client wants to have an identification number associated to the operation. | NO |

| MO/TO | This field refers to the “Mail Order/Telephone Order” action. Field intended when you perform distance sales (e.g. purchase orders received by telephone). Note: This option should only be used if the merchant has an authorization. If you do not have an authorization, the central system will refuse your orders. | NO |

| Name | Client’s name. | NO |

| Surname | Client’s surname. | NO |

| Date of birth | Client’s date of birth. | NO |

| Client’s e-mail. | NO | |

| Country Code | Client’s country code. | NO |

| Mobile | Client’s mobile number. | NO |

| Street (Billing Address) | Billing street address. | NO |

| Postal code (Billing Address) | Billing postal code. | NO |

| Location (Billing Address) | Billing location. | NO |

| Country (Billing Address) | Billing country. | NO |

| Ship to a different address (Billing Address) | To be selected if the client’s shipping address is different from the billing address. | NO |

| Street (Shipping Address) | Shipping street address. | YES (if “Shipping to a different address” is selected) |

| Postal code (Shipping Address) | Shipping postal code. | YES (if “Shipping to a different address” is selected) |

| Location (Shipping Address) | Shipping location. | YES (if “Shipping to a different address” is selected) |

| Country (Shipping Address) | Shipping country. | YES (if “Shipping to a different address” is selected) |

In order to accept a payment using MULTIBANCO references as the payment method, you will need to fill out the following fields:

| Field | Description | Required |

|---|---|---|

| Payment Type | Payment type you want to use: – Authorization: via MULTIBANCO reference. | YES |

| Amount | Total amount of the purchase. Minimum value of 0,01€. | YES |

| Currency | Euro is the predefined, non-editable currency. | YES |

| Entity | Warning: In order to generate a MB WAY operation, leave the field blank. | – |

| Merchant Operation ID | Internal merchant code ID. | YES |

| Merchant User ID | Client’s identificator number. To fill if the client wants to have an identification number associated to the operation. | NO |

| MO/TO | This field refers to the “Mail Order/Telephone Order” action. Field intended when you perform distance sales (e.g. purchase orders received by telephone). This option should only be used if the merchant has an authorization. If you do not have an authorization, the central system will refuse your orders. | NO |

| Minimum amount | Sets a minimum amount to be entered by the client when using the MULTIBANCO reference. | NO |

| Start Date | Sets the start date of the MULTIBANCO reference. | YES |

| Start Hour | Sets the start hour of the MULTIBANCO reference. | YES |

| End Date | Sets the end date of the MULTIBANCO reference. | YES |

| End Hour | Sets the end hour of the MULTIBANCO reference. | YES |

| Name | Client’s name. | NO |

| Surname | Client’s surname. | NO |

| Date of birth | Client’s date of birth. | NO |

| Client’s e-mail. | NO | |

| Country Code | Client’s country code. | NO |

| Mobile | Client’s mobile number. | NO |

| Send Reference | Select “SMS” or “Email” fields if you want to send the MULTIBANCO references to the client. | NO |

| Street (Billing Address) | Billing street address. | NO |

| Postal code (Billing Address) | Billing postal code. | NO |

| Location (Billing Address) | Billing location. | NO |

| Country (Billing Address) | Billing country. | NO |

| Ship to a different address (Billing Address) | To be selected if the client’s shipping address is different from the billing address. | NO |

| Street (Shipping Address) | Shipping street address. | YES (if “Shipping to a different address” is selected) |

| Postal code (Shipping Address) | Shipping postal code. | YES (if “Shipping to a different address” is selected) |

| Location (Shipping Address) | Shipping location. | YES (if “Shipping to a different address” is selected) |

| Country (Shipping Address) | Shipping country. | YES (if “Shipping to a different address” is selected) |

Check Payment Status

After the form is submitted, the vTerminal will display a screen in which you will be able to enter the client’s phone number and click “Confirm”.

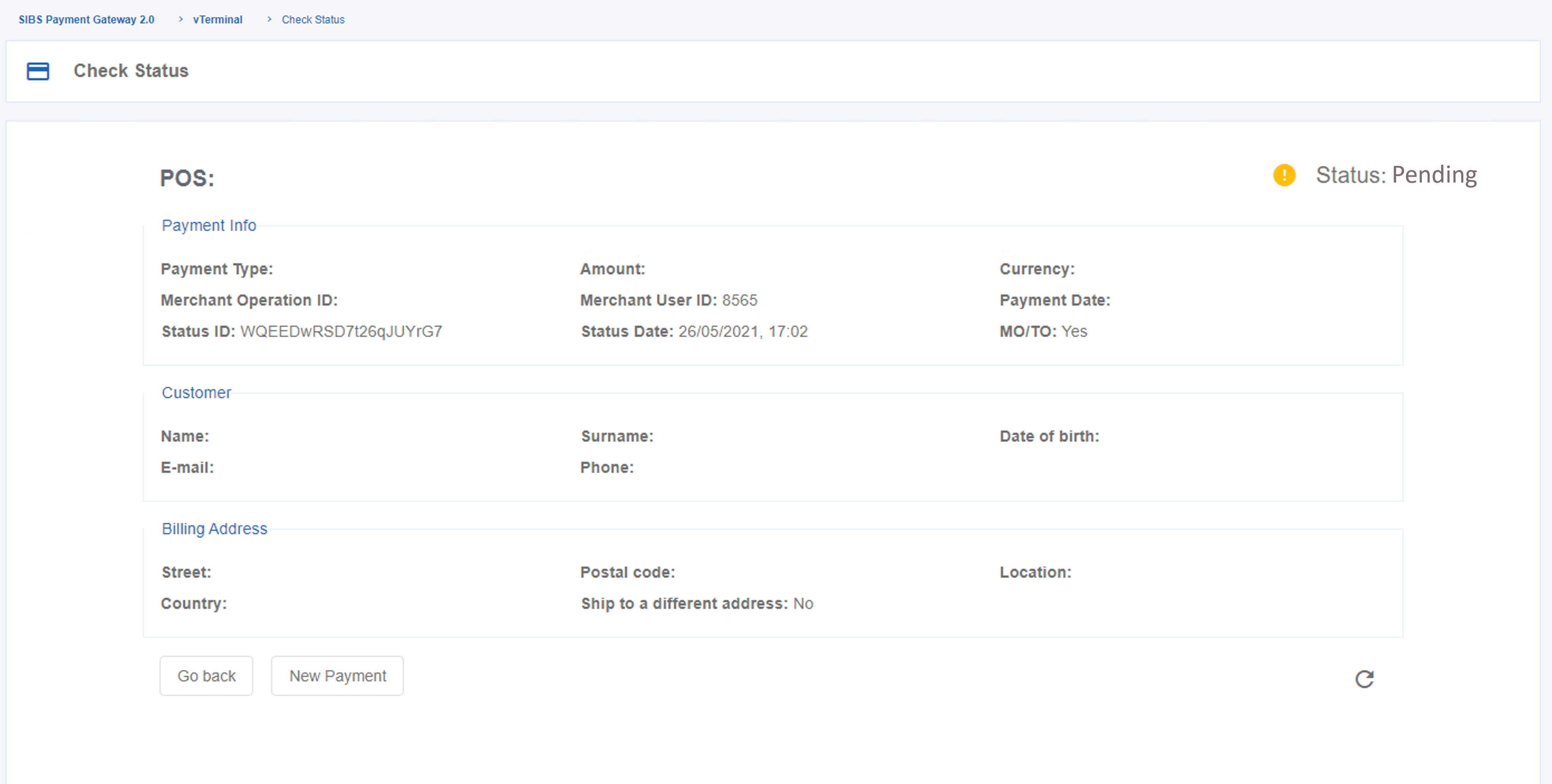

The webpage will redirect you to a “Status” page, in which all operation details will be displayed.

Once the client performs the payment, the webpage will display a “Status: SUCCESS”.