In the chapters available below you will be able to seek information regarding each feature.

Add a search filter

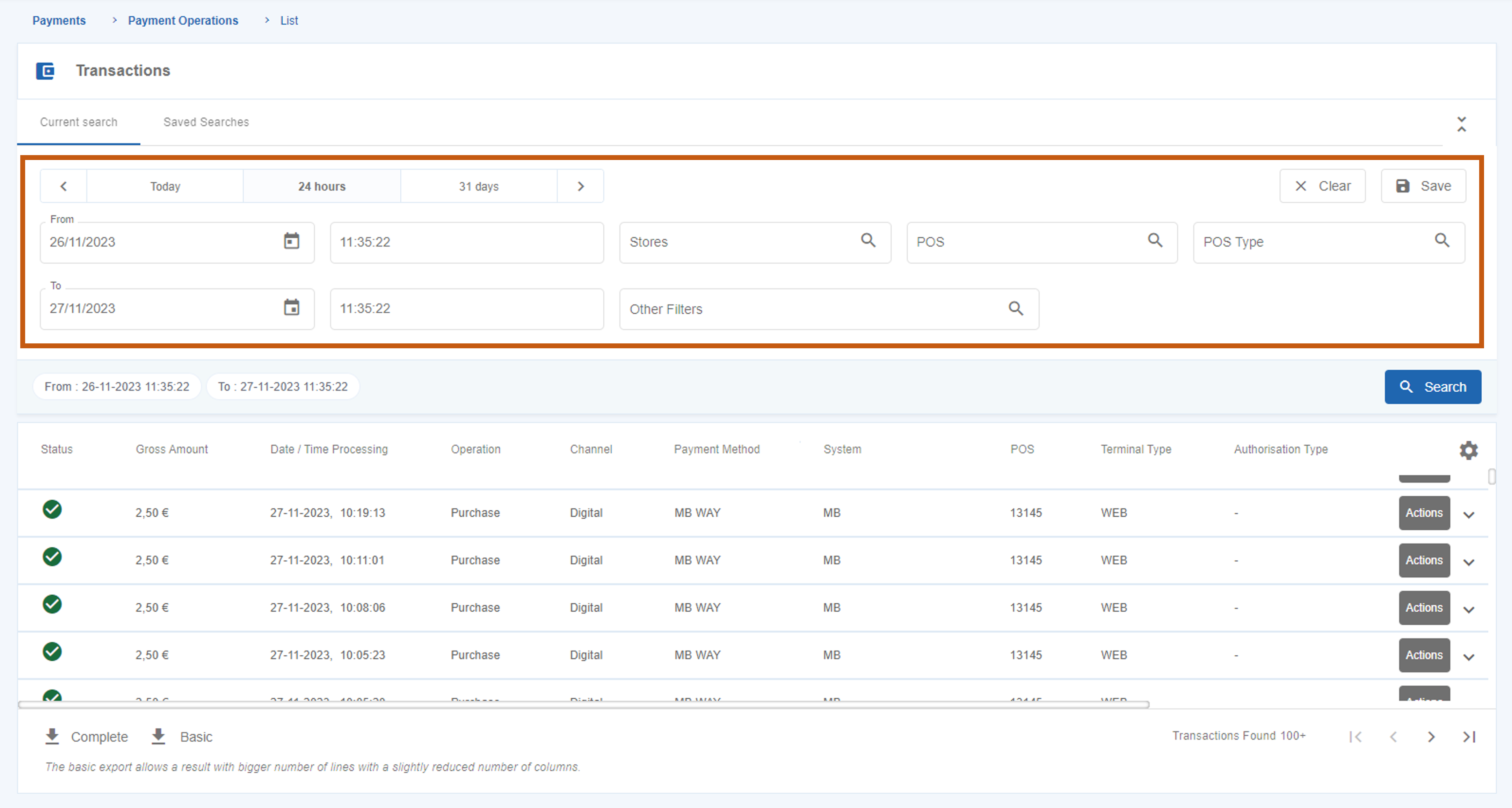

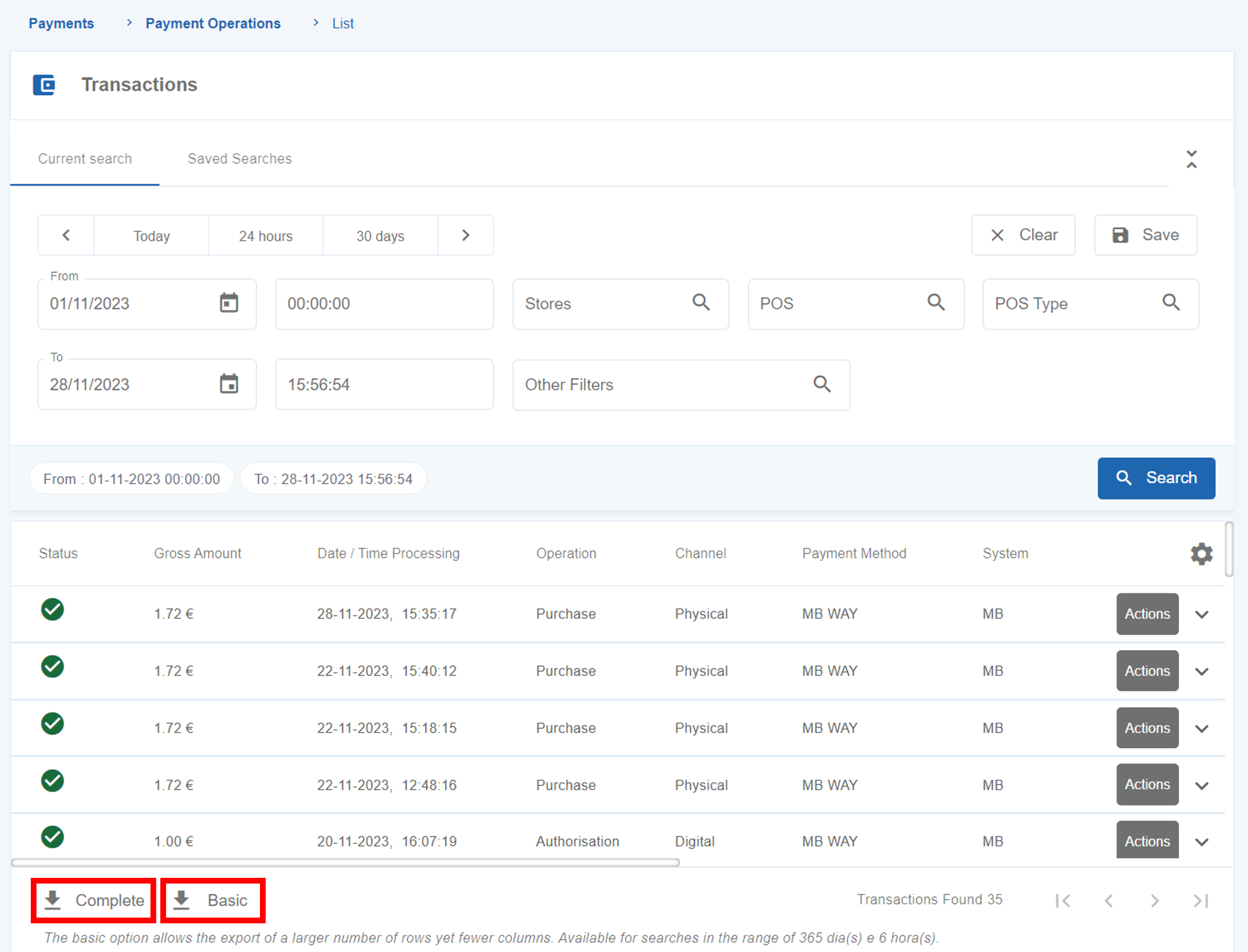

In the “Payments” menu > “Payment Operations” you can see all the transactions in real-time or you can also filter transactions based on several criteria.

General filters

The general filters available in the page are:

Date

This filter allows you to filter per period of time.

You must define the start and end date, or one of the default periods of time:

- Today

- 24 hours

- 30 days

Store

You can also filter transactions by “Store”. The available stores will be visible on filter field.

POS

This filter allows you to filter by POS terminal and you can filter by up to ten different POS terminals.

POS type

This filter allows you to filter by the type of terminal used for transactions (e.g. mPOS, smartPOS).

Filter based on other criteria

In order to filter based on other criteria you can insert one or more filters in the “Other Filters” field.

The available transaction filters are the following:

| Field | Value |

|---|---|

| Acquirer | Choose an option |

| e-Commerce authentication | Choose an option |

| Channel | Choose an option |

| Card | Editable |

| Maximum Fees | Editable |

| Minimum Fees | Editable |

| Client e-mail | Editable |

| Operator email | Editable |

| EAT | Choose an option |

| Payment Entity | Editable |

| Split Delivery | Choose an option |

| Status | Choose an option |

| Merchant operation ID | Editable |

| Transaction ID in the channel | Editable |

| Authorisation ID/ARN | Editable |

| Authorised Payment ID | Editable |

| DCC indicator | Choose an option |

| Fallback indicator | Choose an option |

| Brand | Choose an option |

| Authentication method | Choose an option |

| Payment method | Choose an option |

| Data Retrieval Mode | Choose an option |

| Payment method | Choose an option |

| Maximum Gross Amount | Editable |

| Minimum Gross Amount | Editable |

| Exact Gross Amount | Editable |

| Exact Net Amount | Editable |

| Maximum Net Amount | Editable |

| Minimum Net Amount | Editable |

| Operation | Choose an option |

| Terminal Period | Editable |

| Express QR Code | Choose an option |

| Recurring | Choose an option |

| MB Reference | Editable |

| System | Choose an option |

| MB WAY Mobile Phone | Editable |

| Authorization Type | Choose an option |

| Card Type | Choose an option |

| MIT Type | Choose an option |

| MIT Transaction Type | Choose an option |

| Offline Transaction | Choose an option |

| Maximum Deferred Amount | Editable |

| Minimum Deferred Amount | Editable |

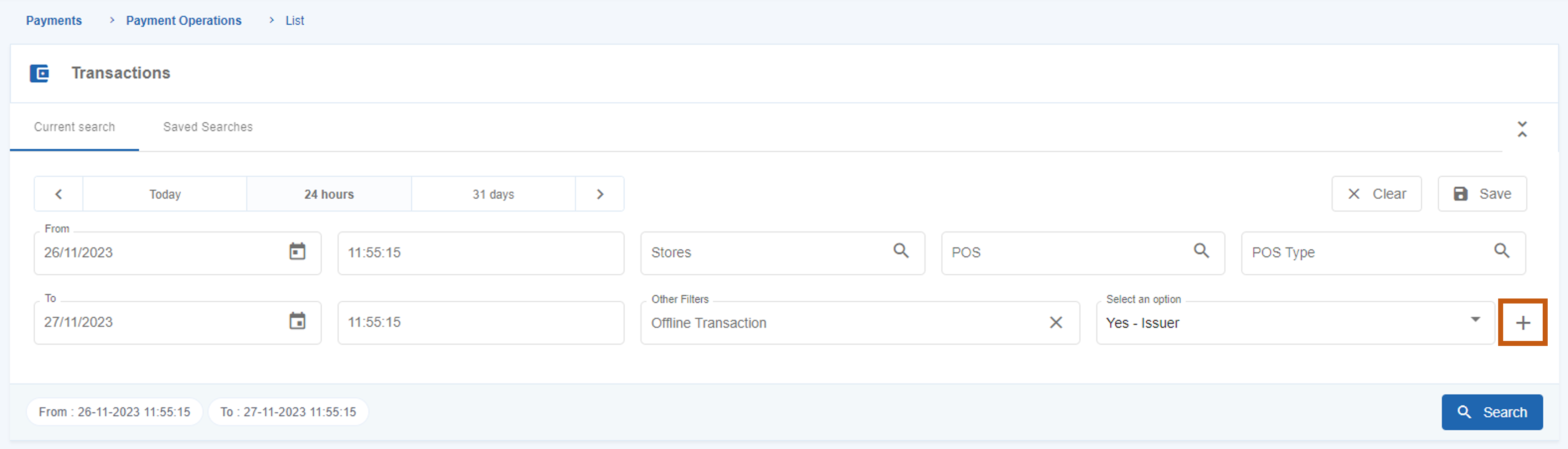

Add several search filters

While carrying out a search you can choose a filter in the “Other Filters” and then press the “+” button, as shown in the picture below.

The selected filter will move to the search line. You can add other filters using this same method until your search criteria is complete.

Save a filtered search

After selecting the intended filters, you can save a search, by pressing the “Save” button available in the page.

After that, a window will pop up asking you to name the saved search.

The search will be available in the “Saved Searches” tab.

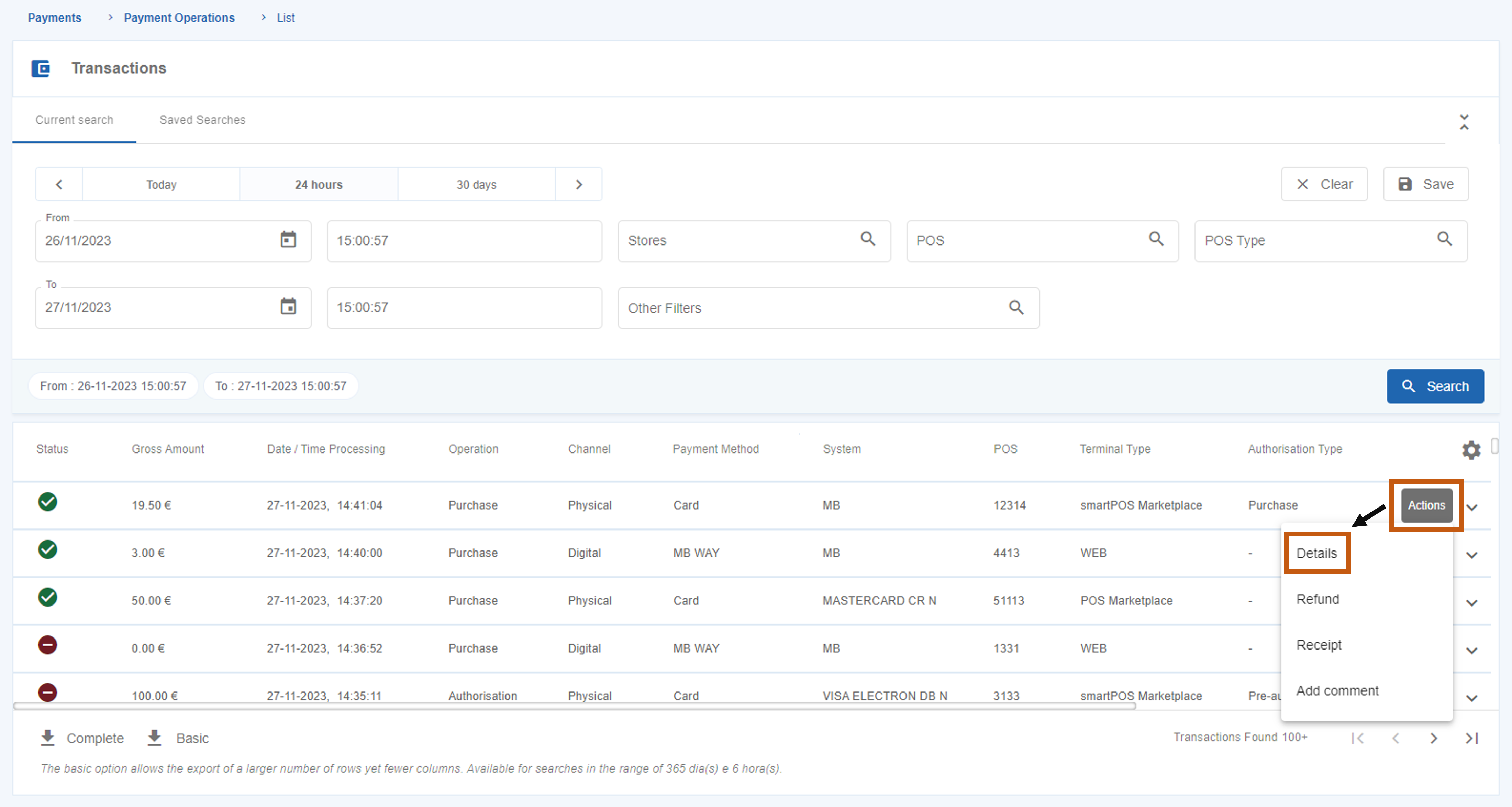

Check transaction details

In order to view the details of a transaction, you must click in the “Actions” button of the transaction and then click in “Details”.

The table below details all the fields displayed on the transaction details. These fields can differ depending on the transaction type.

Transactions

| Field | Description |

|---|---|

| Date / Time Processing | Date and time when the transaction was processed. |

| Terminal Date / Time | Date and time recorded on the terminal when the transaction was processed. Note: It may differ from the processing date and time, particularly on physical terminals. |

| Operation | Type of transaction (e.g. “Purchase” or “Refund”). |

| Gross Amount | Gross amount of the transaction. |

| Net Amount | Net amount of the transaction. |

| Deferred Value | Value of the transaction processed on a deferred basis. Note: Deferred payments are payments for goods and services where the debit to the customer’s account does not occur immediately but at a later date, to be agreed with the payment service provider. Consequently, the date of compensation to the Merchant is also affected. |

| Commissions | Commissions associated with a transaction. Note: SIBS Backoffice does not show commissions for Service Payment transactions. |

| Currency code | Transaction currency code. Has the fixed value 978 – Euro. |

| Status | Transaction status (e.g. “Completed”, “Declined”). |

| Authorisation Type | Identifies the type of authorization operation (e.g. incremental authorization). |

| Error Reason | Informs the error code that occurred in the rejected operations. Note: successful operations are associated with the code “00.000.0000”. |

| Error Description | Gives a description of the error. |

| Channel Transaction ID | Identification of the transaction channel at SIBS. |

| Id (Merchant) | Identification of the Merchant (assigned by the Merchant). |

| Authorisation Id / ARN | Identification of the payment system authorization. |

| Authorisation Key | Identification of the transaction at SIBS. |

| Original Authorisation Key | Identification of the associated transaction in SIBS. |

| External Original Authorization Key | Secondary identification of the transaction in SIBS. |

| Authentication Method | Identification of the authentication method used. |

| Acquirer | Identification of the Acquirer of the transaction. |

| TSE | Identification of the Terminal Support Entity |

| Authorised Payment ID | Identification of the Authorized Payment token. |

| DCC indicator | Identifies whether the transaction used Dynamic Currency Conversion (DCC). DCC is an option for foreign cardholders that allows payment in the card’s home currency or in Euros. |

| Amount in Original Currency | Identification of the amount in the original currency. |

| Fall-Back Indicator | Identifies whether the transaction was decided on a track because the chip data could not be read. |

| Offline Transaction | Identifies whether the transaction was carried out offline. |

Merchant

| Field | Description |

|---|---|

| Merchant | Merchant identification in SIBS systems. |

| Store | Identification of the Merchant’s establishment to which the terminal where the transaction was made belongs. |

Terminal

| Field | Description |

|---|---|

| POS | Identification (number) of the terminal used in the operation. |

| POS brand code | Identifies the brand and model of the terminal (e.g. ZD). |

| Terminal Type | Identifies the type of terminal used (e.g. SmartPOS or WEB). |

| Accounting Period | Identifies the accounting period of the terminal used. |

Acceptance

| Field | Description |

|---|---|

| Channel | Identifies the type of channel (e.g. digital or physical). |

| Acceptance network code | Identifies the network acceptance code. |

| Acceptance channel Type Code | Identifies the type of acceptance in the channel. |

Payment

| Field | Description |

|---|---|

| Payment Type | Identifies the payment mode used, associated with the payment method (e.g. “Contactless” or “QR Code”). |

| QR Code Express Description | Name/description defined by the Merchant when creating the QR Code Express. Valid for transactions with the “QR Code Express” payment method. |

| Scheme | Identifies the brand used in the transaction (e.g. “MB”). |

| System | Identifies the financial system or product used in the transaction. |

| Payment Method | Identifies the payment method used (e.g. “MB WAY”, “Card”). |

| Authentication Method | Identifies the authentication method used in a physical terminal transaction (e.g. “PIN”, “Signature”). |

| eCommerce Authentication | Identifies the authentication method used in a digital or virtual terminal transaction (e.g. “3DS”). |

| Merchant Exemption Request | Identification of the request for a Merchant’s exemption regarding authentication. |

Card

| Field | Description |

|---|---|

| Card Data Entry Mode | Identifies the type of authentication of the operation, from the equipment’s point of view (e.g. “Track”, “Contactless”). |

| Country Code | Indicates the country of the card. |

| Presence | Indicates the presence or absence of a card at the time of payment. |

| MB WAY mobile phone | Identification of the MB WAY phone number. |

| Number | Number of the card used, encrypted. |

Card holder

| Field | Description |

|---|---|

| Code | Customer identification on the merchant. |

| Presence | Indicates whether or not the owner of the card is present. |

| Billing Client Name | Identifies the customer’s name. |

| Customer’s e-mail address. | |

| Phone | Identifies the customer’s phone number. |

| Mobile Phone | Identifies the customer’s mobile phone number. |

| Billing Address | Identifies the billing address provided by the customer. |

| Billing Post Code | Identifies the postal code associated with the billing address provided by the customer. |

| Billing City | Identifies the city associated with the billing address provided by the customer. |

| Card Country Code | Identifies the country associated with the billing address provided by the customer. |

| Shipping Address | Identifies the shipping address provided by the customer. |

| Shipping Postal Code | Identifies the postal code associated with the delivery address provided by the customer. |

| Shipping City | Identifies the city associated with the shipping address provided by the customer. |

| Shipping Country Code | Identifies the country associated with the delivery address provided by the customer. |

Payment reference

| Field | Description |

|---|---|

| Payment Owner Code | Code of the SIBS merchant that generated the reference for payment of services. |

| Payment Entity Code | Identification of the payment of services entity. |

| Payment Entity Reference Code | Number corresponding to the payment of services reference. |

Download/export transaction list

In order to download the list of transactions, click in the “Complete” or “Basic” download button at the end of the Payment Operations page.

The two types of download differ in:

- Complete export: allows you to export up to 30.000 transactions, with all the information the platform has on each transaction;

- Basic export: allows you to export a larger number of rows, up to 100.000 transactions, with a slight reduction in the number of exported columns.

In both export options, if the “Transactions Found” list returns a value higher than the defined limit the application will not be able to export all the transactions. In these cases, an informative pop-up is displayed with the time window considered in the export.

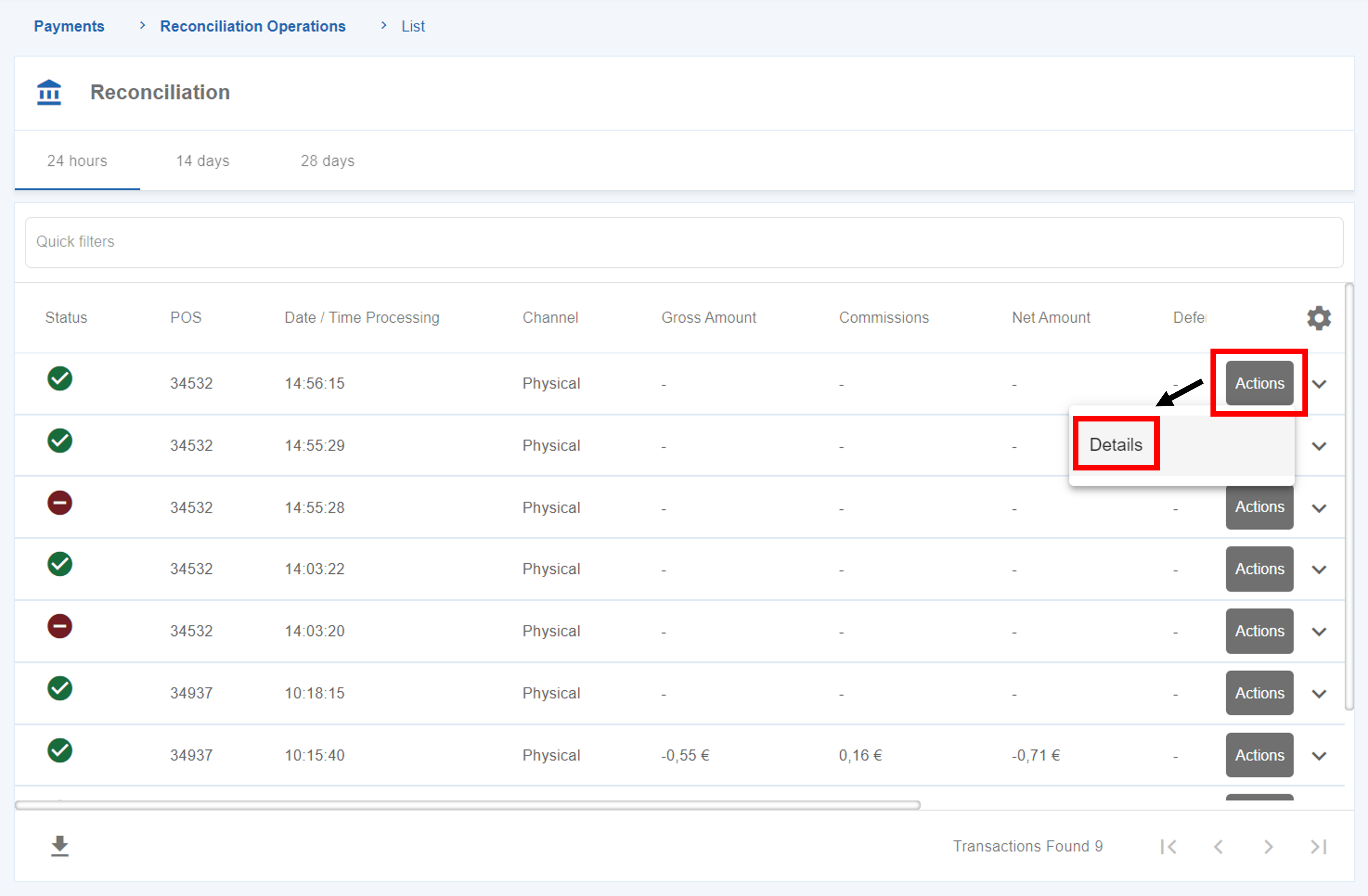

Check reconciliation operations

The “Reconciliation Operations” submenu allows the Merchant to search and check details of reconciliations.

The reconciliation procedures depend on the type of terminal:

- Digital terminal reconciliation: daily automatic reconciliation at 1:00 AM.

- Physical terminal reconciliation: daily reconciliation (minimum) or every 7 days (maximum), noting that there can exist more than one daily reconciliation which can correspond to different accounting periods.

To check the details of a reconciliation, click on the “Actions” button of a reconciliation and then on “Details”.

Check events and audits

The “Events and Audits” menu serves as a directory in which all actions executed by the users will be recorded. It will provide information about the type of actions executed, the user involved, the date and the description of the action.

In order to see the actions performed by all the users, you must have the Owner role in SIBS Backoffice. Other users will only see the record of actions from users with hierarchically lower profile types.